Why Are House Prices So High? (Press Release)

In

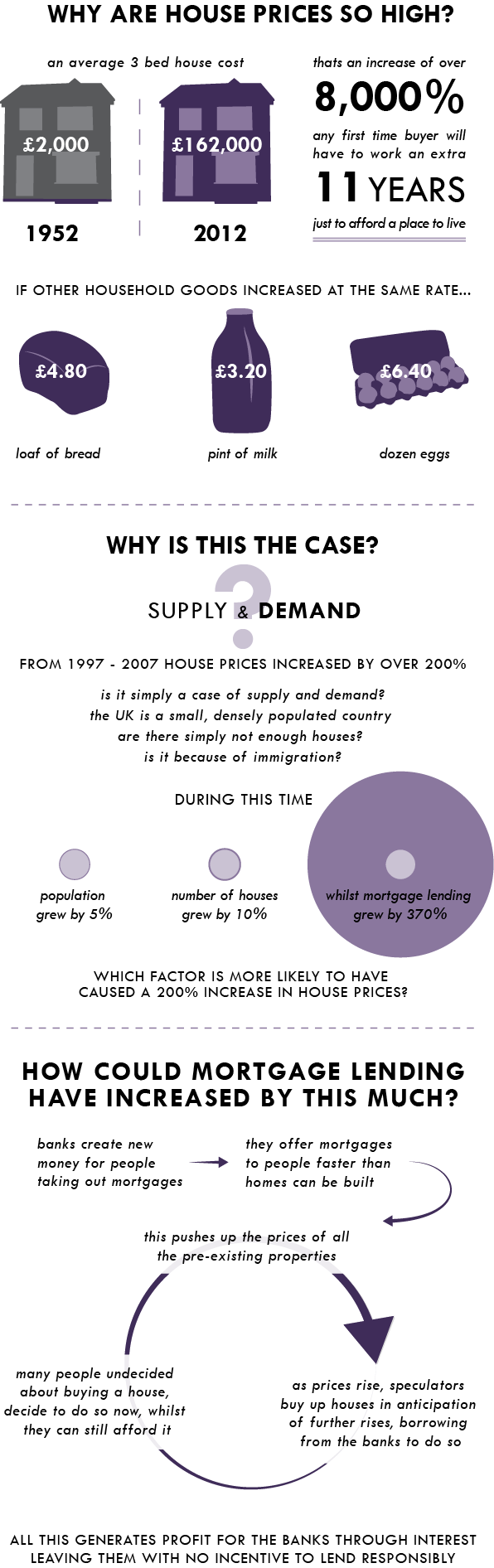

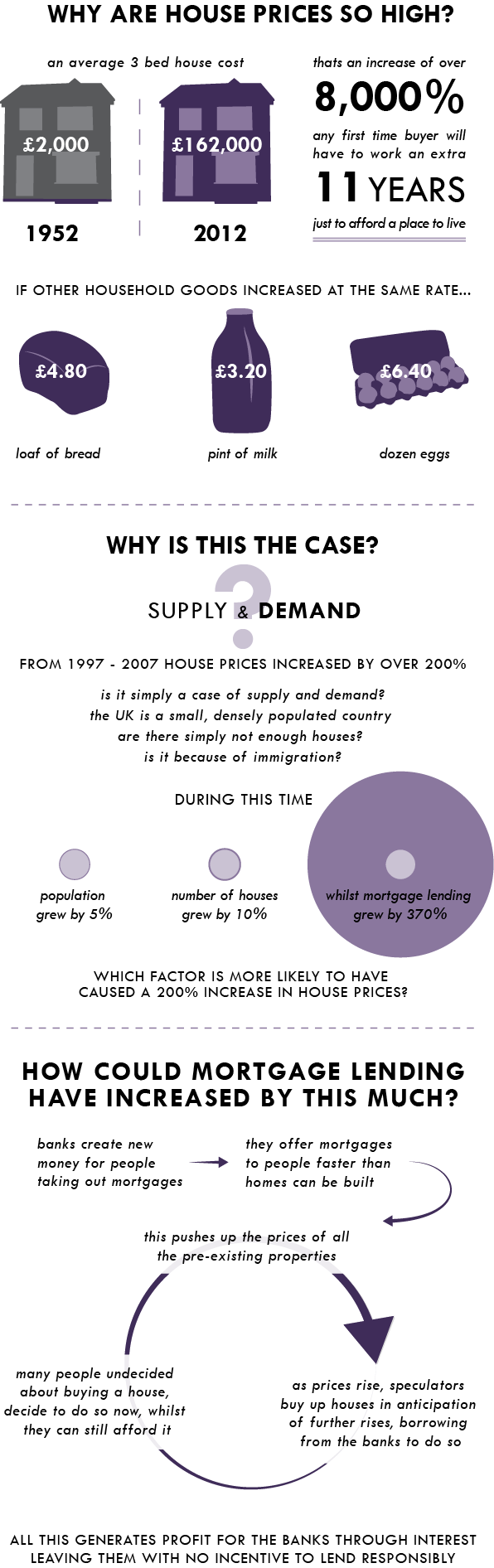

the ten years up to the start of the financial crisis, house prices

rose by over 200%. Why? A common belief is that there are too many

people, too much immigration, and too few houses to go around.

Our new 2 minute video addresses the root causes of the housing crisis. It explains that house prices aren’t high because there’s “too many people and too few houses”. And it answers the crucial question: Why are house prices really so high?

You can find more details on this here:

http://www.positivemoney.org.

and

http://www.positivemoney.org.uk/consequences/house-prices/in-depth/

Our aim is to raise awareness and start conversations about the causes of the housing crisis and get us thinking more critically and creatively about the solutions.

Positive Money is a not-for-profit research and campaign group. They work to raise awareness of the connections between our current monetary and banking system and the serious social, economic and ecological problems that face the UK and the world today. In particular they focus on the role of banks in creating the nation’s money supply through the accounting process they use when they make loans – an aspect of banking which is poorly understood. Positive Money believe these fundamental flaws are at the root of – or a major contributor to – problems of poverty, excessive debt, growing inequality and environmental degradation. For more information, please visit: http://www.positivemoney.org.uk/

Our new 2 minute video addresses the root causes of the housing crisis. It explains that house prices aren’t high because there’s “too many people and too few houses”. And it answers the crucial question: Why are house prices really so high?

(click to enlarge)

You can find more details on this here:

http://www.positivemoney.org.

and

http://www.positivemoney.org.uk/consequences/house-prices/in-depth/

Our aim is to raise awareness and start conversations about the causes of the housing crisis and get us thinking more critically and creatively about the solutions.

Positive Money is a not-for-profit research and campaign group. They work to raise awareness of the connections between our current monetary and banking system and the serious social, economic and ecological problems that face the UK and the world today. In particular they focus on the role of banks in creating the nation’s money supply through the accounting process they use when they make loans – an aspect of banking which is poorly understood. Positive Money believe these fundamental flaws are at the root of – or a major contributor to – problems of poverty, excessive debt, growing inequality and environmental degradation. For more information, please visit: http://www.positivemoney.org.uk/

Contact Us

You can contact us here.Supported By:

Proudly supported by rebuildingsociety.com, a peer to peer lending network that connects local business borrowers with many lenders looking for a better return on saving than what the banks offer.Support Positive Money through your small business, or as an individual

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 3.0 Unported License.

var sc_project=1725605;

var sc_invisible=0;

var sc_partition=16;

var sc_security="acf71b9a";

var sc_project=1725605;

var sc_invisible=0;

var sc_partition=16;

var sc_security="acf71b9a";